Economic - Markets

USDA raises milk output forecast for 2025 and 2026

According to the US Department of Agriculture's Livestock, Dairy, and Poultry Outlook for September, the forecasts for the average number of dairy cows, milk per cow, and total milk production have been revised upward for both 2025 and 2026.

Milk production is projected at 230.0 billion pounds in 2025 and 231.3 billion pounds in 2026. With higher expected milk production, the forecasts for Class III and IV milk prices are revised downward for both years reflecting lower price expectations for Cheddar cheese, butter, and nonfat dry milk. All-milk price forecasts for 2025 and 2026 are $21.35 and $20.40 per hundredweight, respectively.

For the trading week ending September 12 at the Chicago Mercantile Exchange (CME), the average spot prices for Cheddar cheese 500-pound barrels and 40-pound blocks averaged $1.6605 and $1.6535 per pound, respectively. CME spot prices for NDM, butter, and dry whey averaged $1.1890, $1.9565, and $0.5875 per pound, respectively.

For the biweekly period from September 1 to September 12, the average export prices per pound for selected dairy products—based on price ranges reported by Dairy Market News (DMN)—showed mixed movements across Oceania and Europe, with variations by product category compared to the previous biweekly report. Butter prices declined, with Europe averaging $3.46 (down 22 cents) and Oceania at $3.21 (down 5 cents). Skim milk powder (SMP) also saw decreases, with Europe at $1.22 (down 4 cents) and Oceania at $1.21 (down 9 cents). In contrast, dry whey from Europe rose to $0.56 (up 4 cents), while Oceania Cheddar climbed to $2.15 (up 7 cents), reflecting stronger demand in the cheese segment.

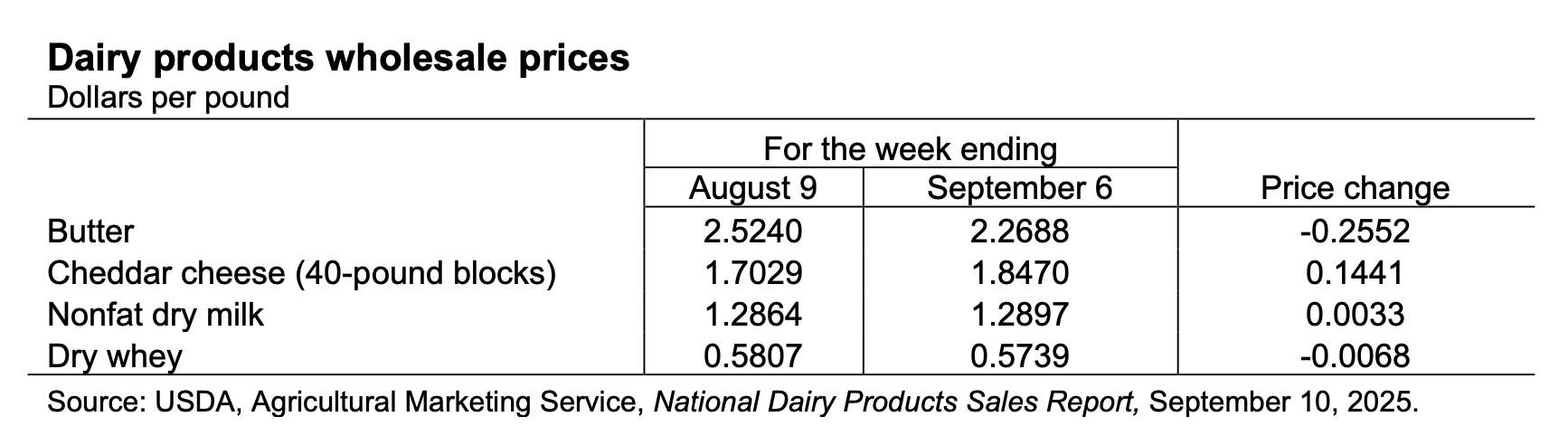

If US dairy manufacturers and brokers are exporting based on NDPSR prices, Cheddar and butter show a clear international competitive advantage and may continue capitalising on export opportunities, as reflected in strong exports so far in 2025. However, SMP faces a disadvantage under these recent pricing conditions, while dry whey prices remain broadly aligned with European levels.