World Markets

The Canadian meat protein industry has been downsized significantly in recent years and it will be quite difficult to once again return to the levels enjoyed in the first half of the past decade.

Here’s what the latest data shows:

The Canadian cattle inventory on 1 July, 2011 was reported at 13.870 million head, 105,000 head or 0.8 per cent lower than a year ago.

The Canadian cattle inventory has been steadily declining in recent years, in line with the reduction in the size of the breeding herd.

The total cattle inventory in Canada peaked in 2005 at 16.880 million head but has declined ever since, especially after shipments of fed and feeder cattle to the US resumed in 2007.

The inventory of breeding animals also has declined steadily in recent years as the industry struggled with rising feed costs, limited export markets and the impact of the global recession.

Producers liquidated a significant portion of the beef and dairy herds and retained fewer heifers for herd rebuilding.

The total cow inventory on 1 July was 5.184 million head, 1.7 per cent lower than a year ago. The entire decline came from lower beef cow numbers, which were reported at 4.202 million head, 90,000 head or 2.1 per cent lower than a year ago and 22.7 per cent lower than on 1 July, 2005.

The inventory of dairy cows has been fairly steady at 982,000 head since 2008 and it remained at those levels in the latest count.

The 1 July cattle inventory showed that beef cow replacement numbers on 1 July were 662,000 head, some 42,000 head or 6.7 per cent larger than a year ago.

Improvements in pasture conditions and better returns have provided an incentive for producers, particularly those in western states to embark on some herd rebuilding activities.

The rise in herd replacement numbers is another indication that the cattle cycle in Canada may have finally hit bottom.

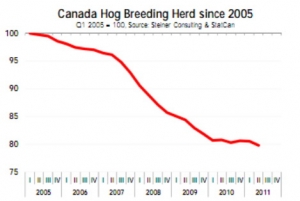

The total inventory of hogs and pigs in Canada as of 1 July was estimated at 11.895 million hogs, up 0.8 per cent compared to a year ago. The inventory of breeding hogs was reported at 1.299 million head, 1.2 per cent less than a year ago.

The decline in sow inventories was surprising as it appeared the breeding herd liquidation had bottomed.

Feed cost pressures and the strong Canadian dollar continue to take their toll, particularly on the feeder segment.

The smaller sow herd led to a sharp contraction in sow farrowings, which declined 3.4 per cent compared to the previous year and in the pig crop, down 2.9 per cent from last year.

Even with a smaller breeding herd, producers indicate farrowing inventions for Q3 at –0.1 per cent and for Q4 at +0.2 per cent.

It remains to be seen if those intentions materialise.