World Markets

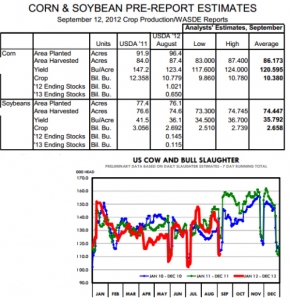

While the trade will, quite understandably, be looking at USDA’s yield estimates, the focus this month is really on harvestedacres. USDA has pegged those figures at 87.4 million for corn and 74.5 million for soybeans in the August reports. That figure for corn is the high of analysts’ pre-report estimates for this month’s report with the average estimate being 86.173 million. That would be just 89.4% of planted acres, the lowest harvested percentage since 2003-04 when 87.9% of acres were harvested. It would still be 3.4% more than were harvested in 1988, the year of the last severe drought in the U.S. Cornbelt.

This is not to say that there is agreement on what USDA will say on yields. Estimates are still over 7 bushels per acre apart from low to high. But they are significantly skewed to the low side. That is not a surprise given recently published estimates. In fact, we were a bit surprised to see the average above 120 bushels per acre given all of the estimates in the 110s over the past few weeks. A crop of 10.380 billion bushels would mean another 400 million bushels would have be cut from usage as we don’t see much way to take carryout stocks below the 650 million estimated in August.

The bean side is not quite as dire. Harvested acres and yield estimates are expected to drop slightly from USDA’s August figures as late-season rains came in time to have some impact on beans in some areas. The average crop estimates is only 2.3% lower than in August.

Cow and bull slaughter have dropped well below the levels of last year since mid-August. The chart at right shows the 7-day running total of USDA’s daily cow and bull slaughter estimate, which spiked sharply higher back in late July but has moderated since that time. Where this number was 10-12% higher, year-on-year, back in July, it has been 10-12% lower in each of the past four weeks.

The devil, of course, is in the details which are not included in the weekly estimates but are available only two weeks in arrears. Total cow slaughter for the week that ended August 24 was 8% lower than last year. That follows weeks of –8.7%, -7.2% and –6.5%. But the breakdown of that slaughter is telling. Dairy cow slaughter during those four weeks was up 10.9%, 7.7%, 12.5% and 9.8%, respectively, from their 2011 levels. Beef cow slaughter was down nearly 20% in each of those four weeks.

The beef cow comparisons, though, are a trap since the beef sector in Texas and Oklahoma was in full-fledged retreat last year in the face of a monumental drought. The 80,000-plus runs of cull beef cows last year were the highest since the last liquidation phase for the beef sector back in 1996. This year’s August totals in the low 60,000s are roughly comparable to 2010 when pasture conditions were not nearly as bad as either last year or this year. While national range conditions are still much worse than one year ago, we need to remember that this herd has already been cut significantly. Just how much farther can it go down? It probably “can” get smaller. But already-lower numbers and the promise of good times for those that can hold on will keep the fall slaughter run of beef cows sharply lower than in 2011, we think.

Dairy cow slaughter for the week of August 24 was 59,950 head. That is the fourth largest figure for that week in our data that go back to 1986 and the second largest since 1987. This sector, of course, is much more susceptible to grain and hay prices. In addition, it can see immediate output price impacts by removing cows from milking herds and reducing milk supplies.